Overview

We wanted to see what the state of automation in multifamily was so we conducted a survey in March and April of 2018. We focused on how effectively two classes of property management companies use marketing automation technology, as well as the quality of their follow-up for leads.

The two classes were divided into “Owner/Operators” (O/O), and “Third-Party Managers” (3PM).

Four Owner/Operators were chosen for the first survey, with eight properties from each company surveyed, for a total of 32 properties. The second survey involved 24 companies, with one property from each company being surveyed.

The properties surveyed were from all over the country in major metro areas. The survey totaled 56 properties from 28 companies.

How We Selected Our Subjects

All properties were aggressively marketed. They were:

- In popular metropolitan areas

- On the first-page results of a prominent ILS

- Marketed as luxury residences

Survey Group 1 Attributes: “O/O”

The first group of surveyed properties were those belonging to the owner/operators. They were chosen if:

- The property was owned and managed by the same company

- The owner/operators chosen were listed in the NMHC’s 2017 “Top 50 Owners” list

Survey Group 2 Attributes: “3rd PM”

The second group of surveyed properties were those belonging to the third-party managers. These are companies that differed from the first group in the following way:

- The property was managed by a company different from the company that owns it

Our Process

The survey lasted for 14 days. We had a member of the Hy.ly team pose as a prospect for the surveys. He used a pseudonym, submitted contact forms for each of the properties surveyed on their website, and recorded all correspondence.

Contact Forms

The contact forms were filled out as comprehensively as possible. We wanted our prospect to appear as the ideal customer so whenever he was asked, he provided the following information:

- Name

- Email

- Phone number

- Desired number of bedrooms

- Desired move-in date

- Desired budget

- That we had no pets

- That we did not need parking

Once the contact forms were submitted, the clock started, and we began recording events.

Our prospect did not reply to any emails or phone calls during the surveys. The only time he reached out to properties was in order to schedule a tour if no online tour scheduler was available.

Tour Scheduling

If the property had a tour self-scheduler on their website, it was used to schedule a tour and the time was marked. If the property did not have a self-scheduler, our prospect called the properties the day after the contact forms were submitted and scheduled a tour that took place the next day.

Missed Tour Follow-Up

Every tour scheduled was going to be missed and measuring how a property interacts with a prospect before and after the tour was crucial to see if there’s effective usage of email automation.

What We Recorded

We measured and recorded the following:

- If the property responded during the survey

- If the property responded within 48 hours of the contact form being submitted

- If the property used auto-responders for new prospects after contact form submission

- If the property had a tour self-scheduler on their website (contact forms with fields allowing prospects to simply request a tour were not counted)

- If the property had an agent personally contact us via phone or email

- The time between the contact form’s submission and contact from an agent

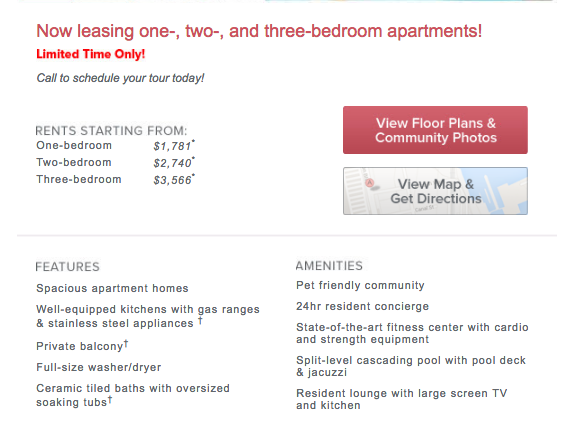

- If the property sent promotional emails (emails selling something or urging the prospect to make an action), and how many

- If the property sent nurturing emails (emails that were informative or checked on our prospect status), and how many

- If the property contacted by phone, and how many times

- The time between the contact form’s submission and the first phone call received

- If the property sent a confirmation email after a tour was scheduled

- The time between the tour scheduling and receipt of the confirmation email

- If the property followed up after the tour was missed

- The total number of phone and email touches made by the property

Our Property Survey Metrics

To recap: We measured Owner/Operators and 3rd Party Managers based on the following metrics:

Is the property responsive?

- How long does the property take to follow-up via email?

- How long does the property take to follow-up via phone?

- Does the property send quality emails to nurture the prospect?

- Does the property have a self-service option to schedule a tour?

- Does the property remind the prospect of their tour?

- Does the property follow up once the prospect missed their tour?

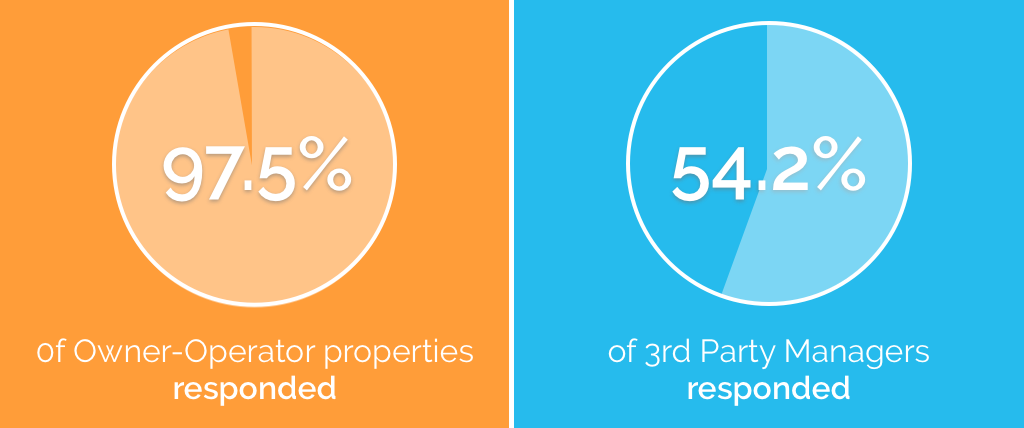

1. Property Responsiveness

Whether the property reciprocated contact with either an email (not an auto-responder) or phone call within 48 hours of the contact form’s submission or not.

Ideally, a property should respond to a prospect within an hour of their contact form’s submission

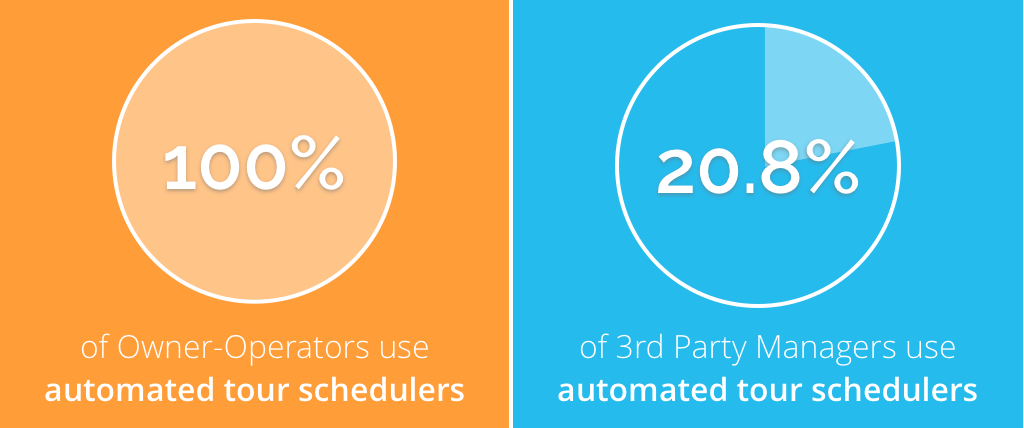

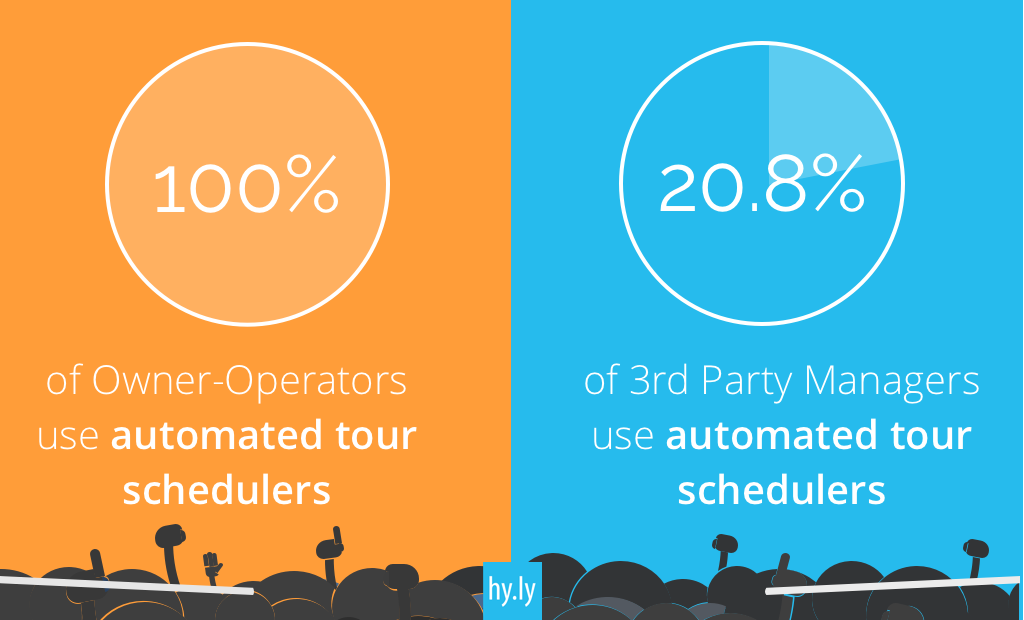

2. Tour Self-Scheduler Usage

Whether the property had a tour self-scheduler on their website or not. A contact form with a field to request a tour was not considered a self-scheduler

A tour self-scheduler was only counted as such if it asked the prospect to choose a date and time on a calendar for their appointment.

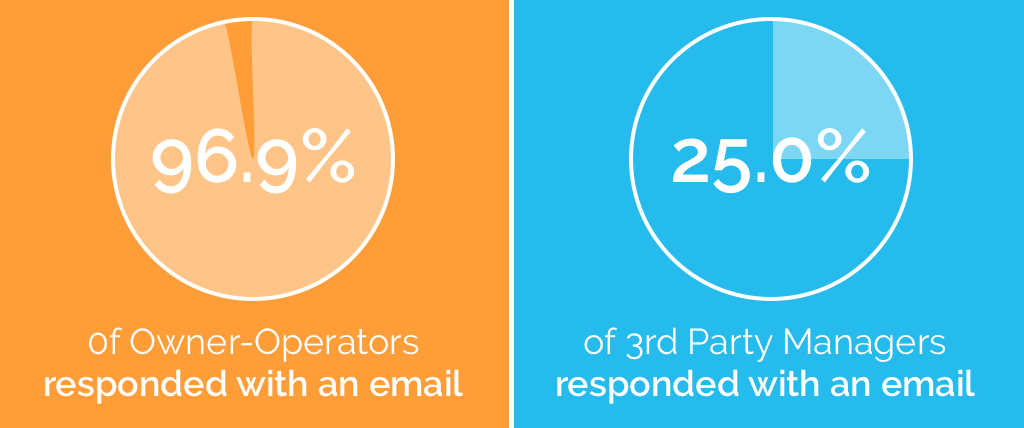

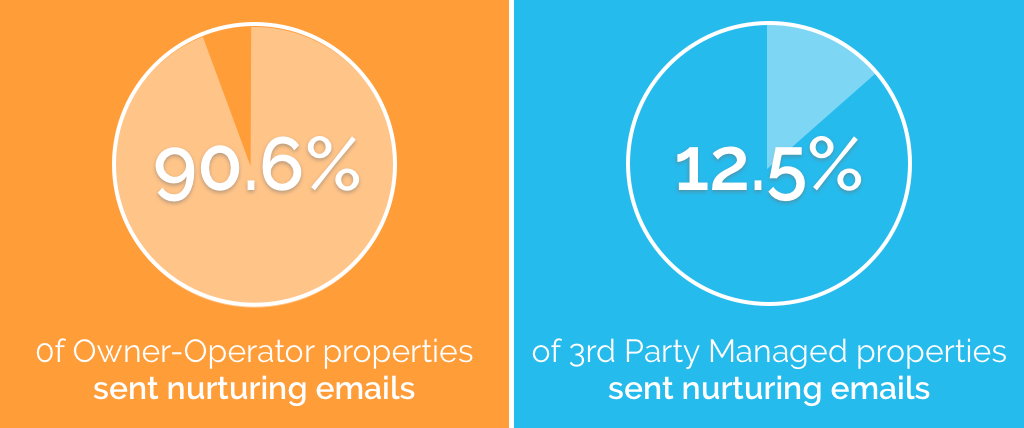

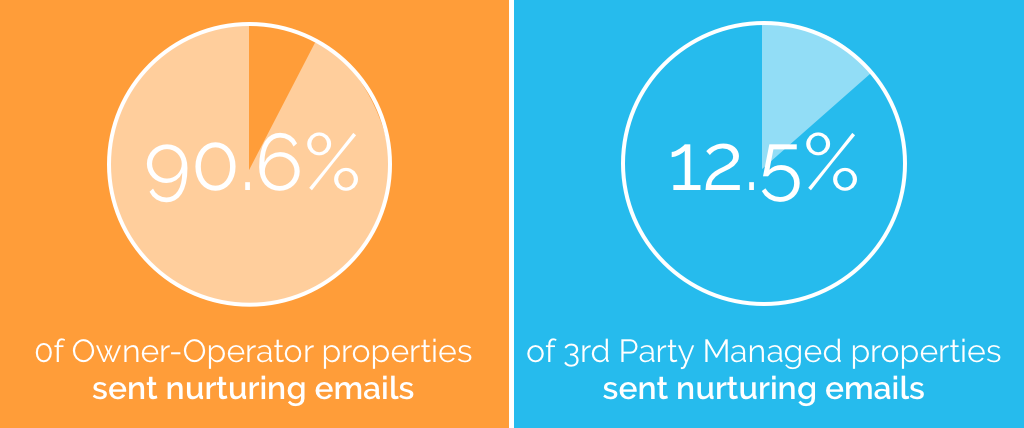

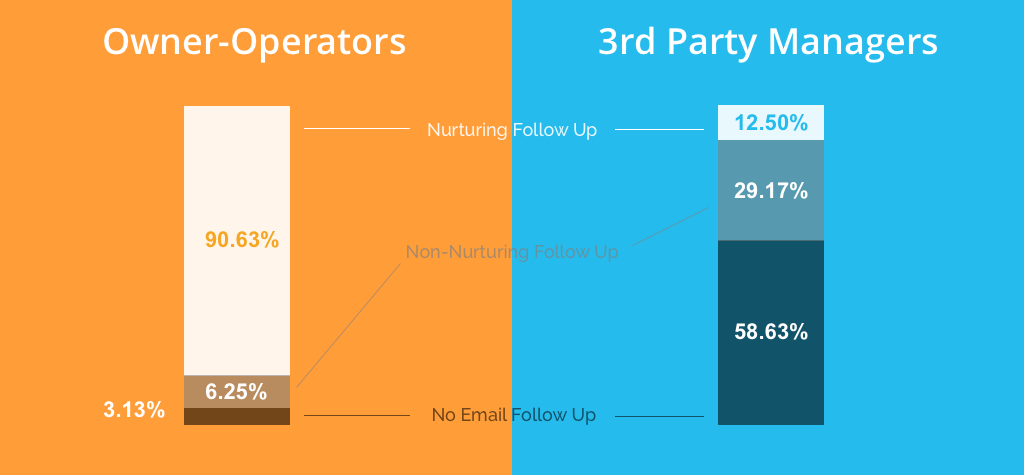

3. Quality of Email Follow-Up

The quality of the emails sent by properties was defined by their being informative and relevant to a prospect’s needs. The emails were classified as:

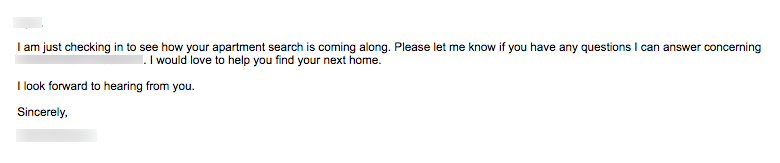

- “Nurturing Emails” (Ideal) – “Nurturing emails,” are emails that serve primarily to provide information about the property. Emails that were status checks from leasing agents that didn’t have any sales or promotional intent were also considered “nurturing emails.”

- “Non-Nurturing Emails” (Mediocre) – “Non-nurturing emails,” were emails that included special offers or other promotional content.

- “No Email Follow-Up” (Poor) – Properties that didn’t send any emails were put in this class.

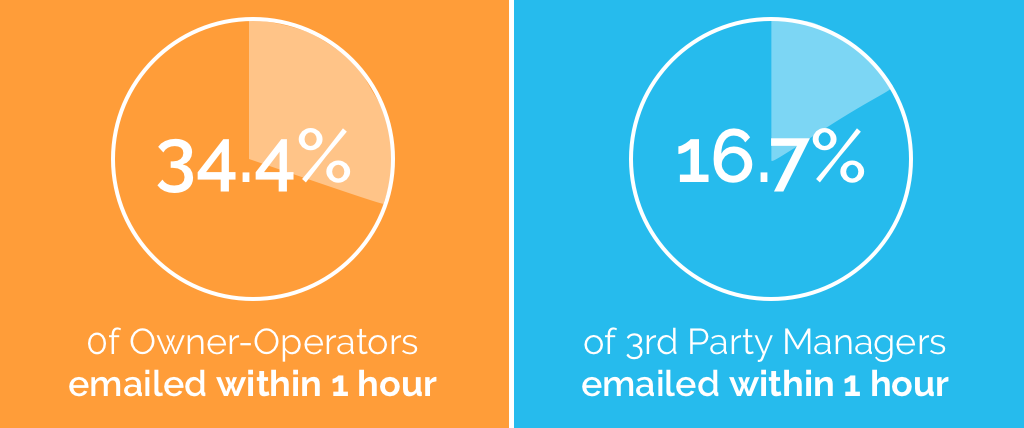

4. Time to Follow-Up via Email

The time properties took to follow-up after our contact form submission via email. Ideally, properties should email within an hour of a contact form being submitted.

The classifications were as follows:

- Sent an email within an hour of contact form submission

- Sent an email between 1-6 hours after contact form submission

- Sent an email 6+ hours after contact form submission

- Did not send any emails

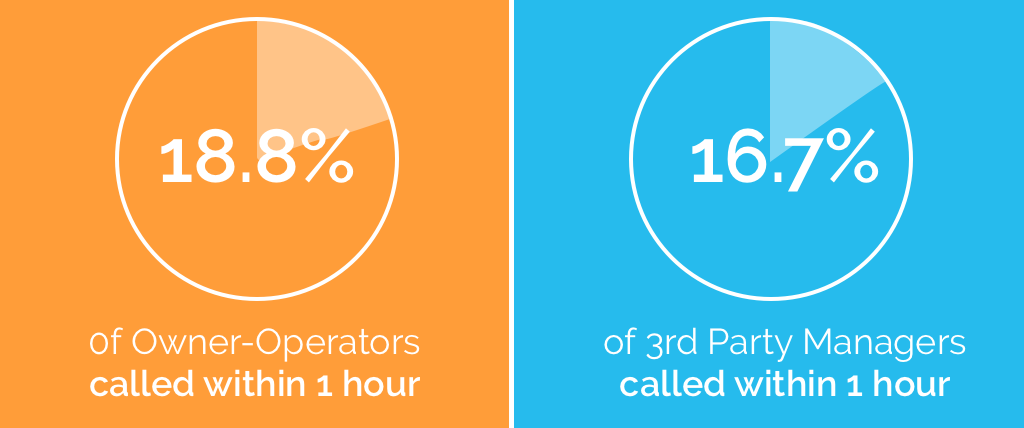

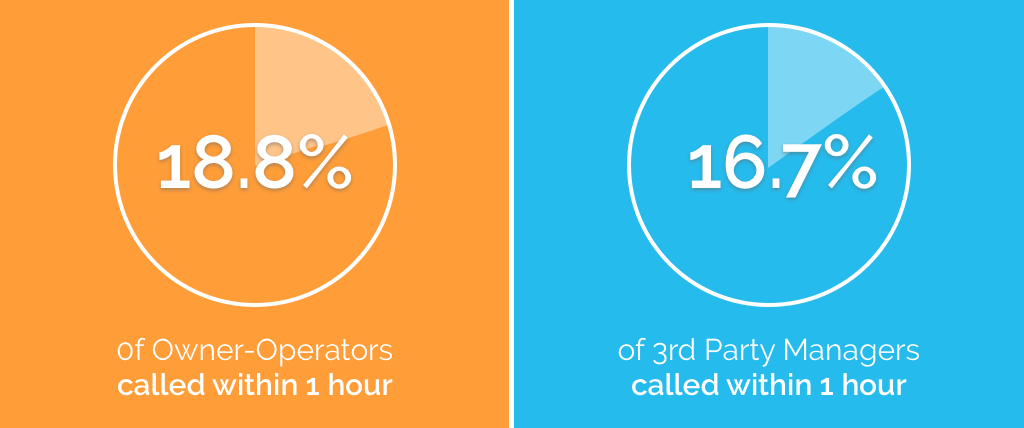

5. Time to Follow-Up via Phone

The time it took a property to contact us via phone after the contact form was submitted. Contact forms were all submitted around 4:00 PM EST, leaving ample time for properties across the country to contact before end of business day. The properties were classified by whether they:

- Contacted via phone within 1 hour of contact form submission

- Contacted via phone within 6 hours of contact form submission

- Contacted via phone 6+ hours after contact form submission

- Did not contact via phone

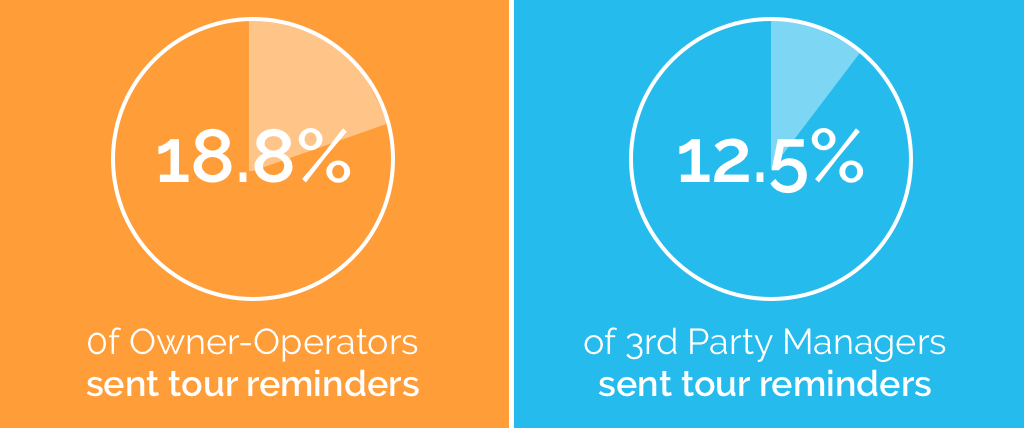

6. Tour Reminder Usage

If properties sent an email before the tour reminding the prospect of their appointment.

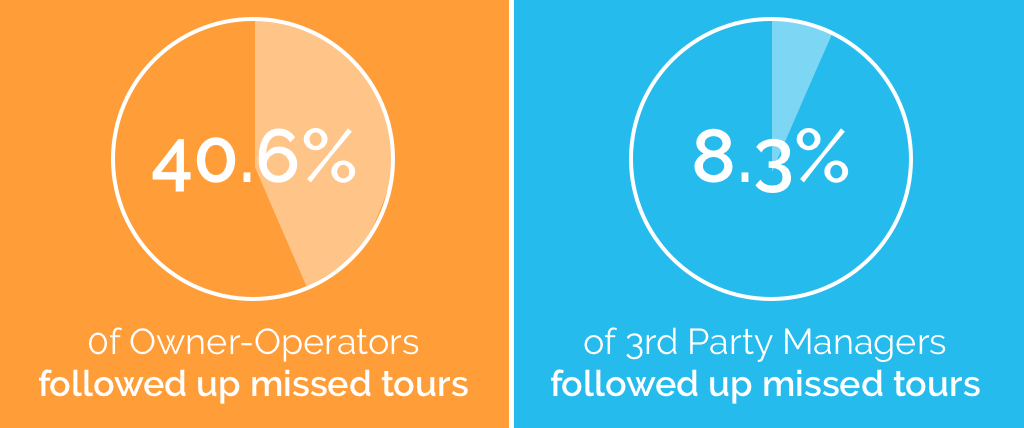

7. Missed Tour Follow-Up

If properties followed up by email or phone after a tour was missed.